Credit card consolidation loans work great for people who owe more than $3,000 to credit card companies. If you owe lesser than $3,000, you can consolidate your loan with a zero or low interest balance transfer credit card. At first, you will have to attend a counseling session so that they can determine how much you are able to pay the creditors every month. They determine this amount based on a realistic monthly budget. Some organizations will charge fees for the counseling sessions while others don’t.

Credit card consolidation loan can help you in reducing the interest rate as well as persuading the creditor to waive the late payment fees. Every month, you will send a single payment to the DMP and this amount will be divided in between your creditors. Normally, you can pay off your entire credit card debt within a 3 – 5 years term of the DMP plan. As you continue to make the repayment punctually, you will see an increase in the credit score.

The credit card relief consolidation loans program can also reduce the monthly outgoing payments to a level that you can cope with. This is much better than making a minimum payment which usually only covers the interest rates leaving no changes on the principal amount you owe on the credit cards. It will create a favorable repayment plan based on your financial situation so that you can repay your debt quickly. You will see an increase in your credit score when you are able to keep up with the repayment of the debt consolidation loan.

Before joining a debt consolidation program, you must list down the interest rates of your credit cards and calculate how much repayment you have to make to clear the debts. You also have to calculate the length of time it takes for you to pay off your credit card. After that, you must compare these figures to that of the credit card consolidation loan. The credit card consolidation loan is a good optionif the math makes sense or that you are stuck in a situation with a lot of debts with high interest rates waiting for you to pay.

The problem with credit card consolidation loan is that it will reset the balance of your credit card to zero so that you can charge your card again. It is not suitable for you if you know you can’t control yourself from not using the credit card again. So, if you want to apply for a consolidation loan, you must make sure that you have already make up your mind not to charge the card again.

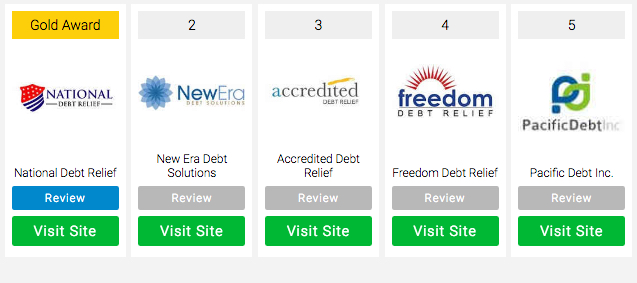

In order to get approved for the credit card consolidation loan, they will want to assess your credit risk by reviewing your financial situation. Usually, you can easily get qualified with a good credit rating and low amount of outstanding debt. You must not forget to do research on the credit counseling organization and make sure that it is equipped with well trained debt relief professionals. You can check the reputation of the credit counseling organizations at the BBB or the official site of the state attorney general’s office.